Did I say mandatory? I meant optional! You’re “free” to die in a cardboard box under a freeway as a market capitalist scarecrow warning to the other ants so they keep showing up to make us more!

I think the real solution is not to lend on fake money. Tax or no tax, it wasn’t taxes that caused the market crash in 2008.

What’s crazy is to calculate the average US income the census folks of the US government exclude billionaires because it would skew reality so much that people would call bullshit on the average with billionaires in the mix.

so they get to be excluded from the “average wage per family” calculations made and distributed by the government.

I wouldn’t be a huge fan of taxing unrealized gains if we hadn’t been cutting taxes for the rich for 50 years. How else are we ever going to recover from that? These guys COULD have done the right thing and supported sensible taxation policies, but they didn’t, so fuck 'em. At this point it’s either this or the guillotine.

The top 10% own 67% of the wealth in the U.S.

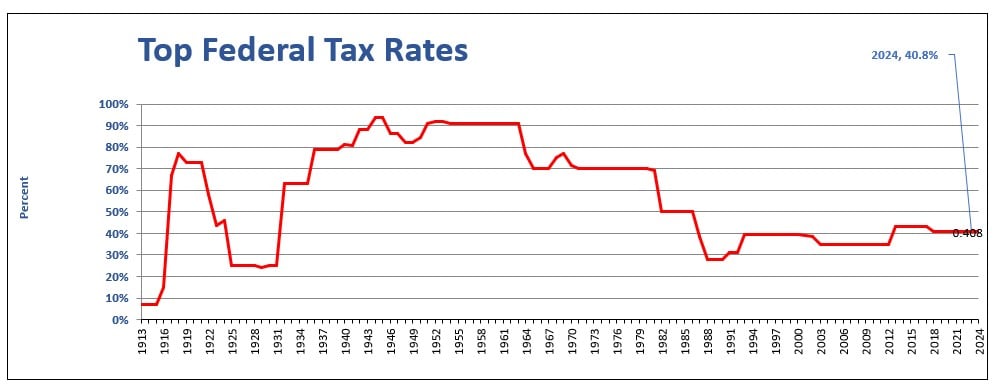

The tax rate during the New Deal (which corresponded with the largest jump in GDP and middle class growth) on people earning $200k and over (now would be like earning $2.5 million/year) was 95%.

During the 50’s through the early 80’s, that tax on the wealthiest was at 70%.

Now it’s at 37%, less than half of what it was during the best years of growth our country ever experienced.

This Unrealized gains tax would only impact people worth more than $100 million who do not pay at least a 25% tax rate on their income.

Additionally, you’d only pay taxes on unrealized capital gains if at least 80% of your wealth is in tradeable assets (i.e., not shares of private startups or real estate). One caveat is that there would be a deferred tax of up to 10% on unrealized capital gains upon exit.

In short, it would not apply to most startup founders or investors, but would impact top hedge fund managers.

They can afford it. TAX THEM.

I don’t agree with unrealized gains taxes in general, but the instant they are used as collateral, or if value in any way is extracted from them (even loan value), they become realized gains, and should be taxed.

I don’t agree with unrealized gains taxes in general, but the instant they are used as collateral, or if value in any way is extracted from them (even loan value), they become realized gains, and should be taxed.

What you’re suggesting would also mean you’re advocating for middle class homeowners to be taxed on a full value of a Home Equity Line of Credit (HELOC) even if they haven’t spent a dime of it yet. Was that your intention?

Homeowners are excluded from capital gains tax for the first 250k for individual filers.

I believe you’re referring to rules on sale of a home where there is a capital gain, meaning you bought the house for $100k and sell it for $350k, no cap gains taxes. We’re in uncharted waters with what @bastion@feddit.nl is proposing. That user (possibly) suggesting it for HELOCs too.

Okay but you can just apply the same logic to a HELOC. If you get a 30k HELOC for a bedroom renovation then it does not count towards capital gains tax.

Even normal capital gains taxes have brackets.

Okay but you can just apply the same logic to a HELOC. If you get a 30k HELOC for a bedroom renovation then it does not count towards capital gains tax.

Wouldn’t this be a double standard if we’re applying @bastion@feddit.nl 's logic? The rich would get taxed on loaned money but the middle class wouldn’t?

This is how… EVERYTHING works… Income tax brackets, 401k limits. I thought this was pretty obvious, from each according their ability and all.

That’s generally how progressive tax brackets work, yes. Technically speaking if I rich person wants to take out a 30k HELOC they’d also not get taxed on it.

How does this actually make any sense though? All collateral is, is a safety net to mitigate loss for a lender who lends to someone who then defaults on the loan. If the loan is not defaulted on, literally nothing happens to the collateral.

How then does it make any sense to consider the mere act of the loan being given as a realization of the collateral, in other words, equivalent to having sold the collateral, when literally nothing has happened to it?

This feels completely arbitrary. Using an asset as collateral is nothing like realizing it.

And WHAT gain exactly is being taxed? So you have a $1000 investment. The government decides, what, that you are a good investor and can make 20% so they’ll tax you on $200? So if you sell it at a loss, you get screwed. If you sell it for a 50% gain the government loses tax revenue? You know what, I’ll take that deal. I’ll invest money, pay the taxes on my unknown gain immediately, keep it for 20 years and boom, tax free, because I’ve already paid the taxes on the gain. You know I’m totally on board with this whole rich people suck idea, but this is just stupid.

ok, so I understand that you don’t quite get the issue, also your bad at taxes.

if I invest $50000 and make $100000 I don’t want to pay taxes on the $50000 I “made” (this normally would lead to the crime of not paying taxes) but if I use those $50000 as leverage on an extremely low interest loan for $50000 then I dodge having to pay anything in taxes while also, defacto, realizing my gains.

what OP is advocating for is taxing those $50000 you put up as collateral, making these $50000 similar to the original $50000 you invested, now should you again make another $20000 from said capital, and pull out, you would still have to pay capital gains on those $20000, or do you think you have to pay capital gains on money you put in? (hence why you’re bad at taxes) because tax is only levied on the positive difference

I think a law stating you can’t borrow against unrealized gains would be sensible.

You can keep your unrealized gains forever, live of your dividends for all i care, and pay no tax. But realizing them, either through selling or borrowing against, triggers a taxation.

Or doing so, it counts the loan as income and is taxed accordingly. But seriously, the main aim itself can also be taxed. A house is…